When financial statements are distributed by a business or other organization, the common rules that must be followed are known as generally accepted accounting principles or GAAP. This is more likely to occur when there are common rules for financial reporting. to make informed decisions, it is necessary to have financial statements that are consistent and which can be compared to the financial statements of other corporations. Whenever the IASC forms a new accounting standard.

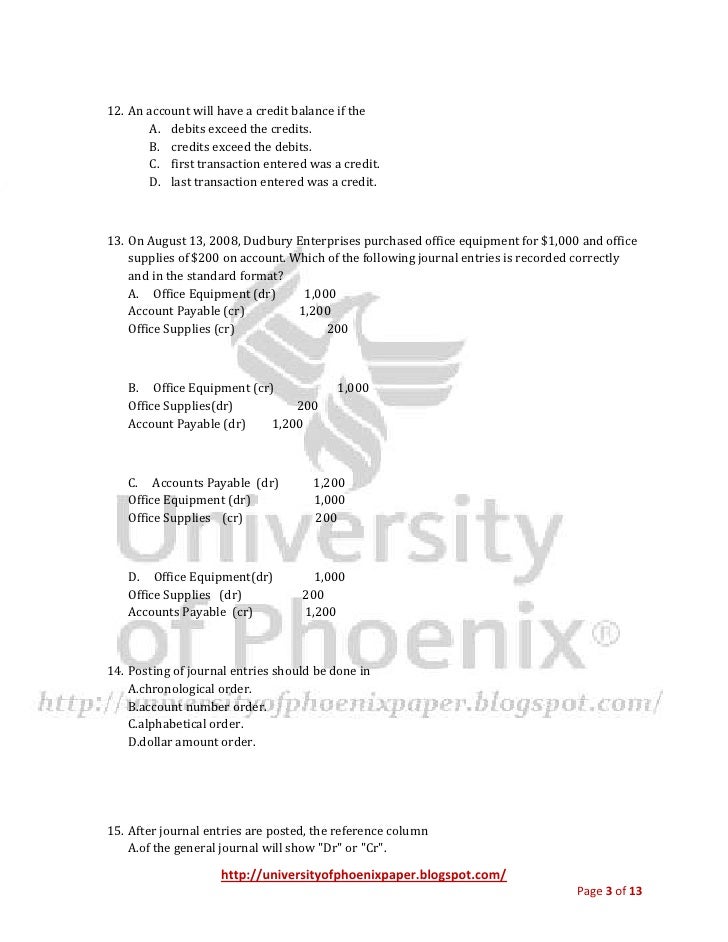

In order for investors, bankers, financial analysts, portfolio managers, etc. Although the IASC is a powerful entity, it still does not directly control or set the rules for the GAAP. Some of the characteristics include objectivity, conservatism, materiality, cost/benefit, comparability, relevance, and timeliness. In addition to the basic underlying accounting principles, there are various characteristics that also guide accountants. These principles are used by the Financial Accounting Standards Board to outline its approved methods of accounting and how and what should be included in an organization's financial reports.

#Gaap stands for full#

The basic underlying accounting principles are: GAAP stands for Generally Accepted Accounting Principles. Looking for the definition of GAAP Find out what is the full meaning of GAAP on Generally Accepted Accounting Principles is one option.

Detailed reporting standards and other rules established and organized by the Financial Accounting Standards Board (FASB) in its Accounting Standards Codification (FASB ASC)Įxamples of the Basic Underlying Accounting Principles Generally Accepted Accounting Practice in the UK (UK GAAP) is the body of accounting standards published by the UKs Financial Reporting Council (FRC).Basic underlying accounting principles, assumptions, and concepts such as the cost principle, matching principle, full disclosure principle, and more.GAAP is the acronym for generally accepted accounting principles.

0 kommentar(er)

0 kommentar(er)